In recent years, there has been a noticeable shift in how people think about wealth preservation and growth. While traditional investments have long dominated the landscape, a growing number of UK investors are diversifying their portfolios by exploring alternatives. This trend reflects a broader interest in finding unique opportunities beyond mainstream instruments like stocks and bonds. This blog post delves into this fascinating trend.

As economic uncertainties persist, people continue to look for innovative ways to protect and enhance their wealth. The UK’s interest in alternative investments is increasingly capturing the market’s attention. Tangible assets have become attractive to those seeking diversification and possibly higher returns, driven by passion and personal interest rather than mere monetary gain.

Page Contents

ToggleGrowing interest in alternative investments

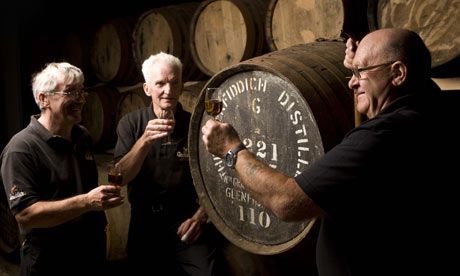

The concept of traditional investment avenues is beginning to feel limited to many, partly due to the volatile nature of the markets and economic shifts. Investors are now looking at whisky, art, and classic cars as serious contenders in the investment realm. Whisky, especially rare and aged bottles, offers substantial potential for appreciation. The art market offers investors a way to engage with culture and aesthetic beauty while owning pieces that may increase in value over time.

Whisky has seen a dramatic rise in interest, with certain bottles fetching extraordinary prices at auctions. Meanwhile, the art market continues to attract attention due to its ability to reflect societal changes and trends, thereby retaining its status as a resilient form of investment. Classic cars offer a sense of nostalgia and luxury, adding personal fulfillment along with financial potential.

Risks and rewards in collectable luxury goods

Investing in luxury collectables such as whisky, art, and cars involves unique risks and rewards. The whisky market is relatively new and driven by passion and rarity, leading to potential volatility. Art collecting requires expertise and an understanding of current trends to ensure a sound investment. Classic cars demand a keen eye for detail and market trends, involving not only purchase costs but also maintenance and restoration expenses.

The fluctuating values associated with these markets can result in both significant profits and losses. Therefore, investors need to approach these opportunities with caution and informed decision-making. Diversification across various asset types and thorough research are crucial. Understanding the provenance, authenticity, and market trends of these luxury items is essential in maximizing potential returns and minimizing risks.

Practical steps for UK investors

For those considering these alternatives, it’s essential to start by thoroughly researching each market. Understanding the nuances and demands of each asset type can aid in making informed decisions. Potential investors should consider consulting experts in each field, whether it’s whisky connoisseurs, art appraisers, or classic car specialists. Keeping abreast of market trends and news can also provide invaluable insights and foresight.

Beginning with smaller investments may be prudent for those new to these markets, allowing investors to gain experience and confidence gradually. Engaging with communities of fellow investors can also provide support and sharing of insights. By taking calculated steps and continually educating oneself, the potential for success in these niche markets can be significantly enhanced.

Conclusion: The future of investment alternatives

As the investment landscape continues to evolve, the popularity of alternative investments in the UK is likely to grow. Although not without risks, such markets offer unique opportunities for those willing to explore beyond conventional avenues. With the proper knowledge and strategy, tangible assets like whisky, art, and classic cars can serve as valuable additions to a diversified investment portfolio.

Engaging with these unique investment opportunities is not merely about financial gain but also about enjoying the journey of collecting and preserving culture. As more individuals recognize their potential, the future of alternative investments in the UK appears promising, offering both financial and personal rewards to discerning investors.