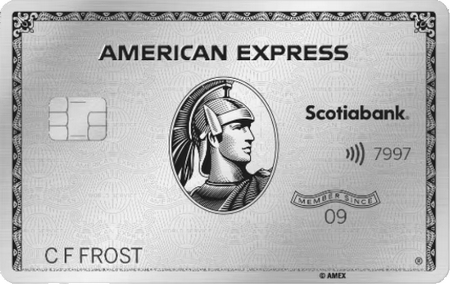

Are you in search of a credit card that offers both convenience and generous rewards for your spending? Look no further than the Scotiabank Platinum American Express® Card. This esteemed card not only ensures secure transactions for your everyday purchases but also boasts a wide array of benefits tailored to your lifestyle requirements.

Whether you’re shopping, dining out, or traveling, this card offers unmatched perks and privileges, making it the ideal choice for discerning individuals seeking both practicality and luxury in their credit card experience.

Page Contents

ToggleKey information about the credit card

The Scotiabank Platinum American Express® Card stands out with its exceptional features and benefits:

- Annual Fee: $399/year

- Interest Rates: 9.99% on purchases, 9.99% on cash advances

- Minimum Credit Limit: $10,000

- Supplementary Card Fee: $99/year

How does the annual fee work?

At $399 per year, the annual fee for the Scotiabank Platinum American Express® Card may seem substantial. However, the benefits it offers far surpass the fee, especially for individuals who actively utilize its features and capitalize on its rewards program.

Whether you’re leveraging its double Scene+™ points on eligible purchases, enjoying the convenience of zero foreign transaction fees, or taking advantage of exclusive offers like mobile device insurance and airport lounge access, the value gained from this card can significantly outweigh its annual cost for those who make the most of its perks.

Understanding the determination of the credit limit

The credit limit for the Scotiabank Platinum American Express® Card is determined by considering several factors, such as your credit history, income level, and current financial commitments. Scotiabank conducts a thorough assessment of these elements to establish a credit limit that is appropriate for your individual financial situation.

By analyzing your creditworthiness and financial capability, Scotiabank aims to allocate a credit limit that aligns with your needs and ensures responsible credit management. This personalized approach helps to safeguard against overextension while providing you with the purchasing power you require to meet your financial goals effectively.

Advantages of the Scotiabank Platinum American Express® Card

This credit card offers a multitude of advantages, making it an excellent choice for discerning consumers:

- 2X Scene+™ Points: Earn double the Scene+ points for every $1 you spend on eligible purchases, allowing you to accumulate rewards faster.

- No Foreign Transaction Fees: Save 2.5% on foreign transaction fees, making it ideal for frequent travelers or those who shop internationally.

- Special Offers: Benefit from exclusive offers and experiences, including airport lounge access, mobile device insurance, and premium concierge services.

A standout advantage

A standout advantage of the Scotiabank Platinum American Express® Card is its zero foreign transaction fees policy. Unlike numerous other credit cards, this feature enables cardholders to make purchases abroad without facing additional fees, resulting in substantial savings for international travelers and online shoppers alike.

Whether you’re exploring foreign destinations or indulging in global online shopping, this benefit ensures that you can transact seamlessly without worrying about additional charges, making it an invaluable companion for those who frequently engage in international transactions.

Disadvantages of the Scotiabank Platinum American Express® Card

While the Scotiabank Platinum American Express® Card offers numerous benefits, it’s essential to consider any potential drawbacks:

- Annual Fee: The annual fee of $399 might deter individuals who prefer cards with no annual fees or lower fees.

- Limited Cash Back Rewards: If you primarily seek cash back rewards rather than travel or entertainment perks, this card may not align with your preferences.

A standout disadvantage

Despite its numerous advantages, the Scotiabank Platinum American Express® Card does have one notable drawback: its comparatively high annual fee in relation to other credit cards available. While the benefits of the card may justify this fee for certain users, others might find it prohibitive, particularly if they do not fully leverage its features.

It’s essential for potential cardholders to carefully evaluate their spending habits and determine whether the benefits offered by the card align with their lifestyle and financial needs. For those who may not utilize the card’s features extensively, the annual fee may outweigh the benefits, making it less attractive as a credit card option.

Eligibility and application process

Individuals interested in applying for the Scotiabank Platinum American Express® Card must meet certain criteria:

- Be of legal age in their province or territory of residence

- Have a minimum annual income

- Meet the credit criteria set by Scotiabank

How to apply for the card

You can apply for the Scotiabank Platinum American Express® Card conveniently through various channels:

- Online: Visit the Scotiabank website and fill out the online application form.

- Mobile App: Apply through the Scotiabank mobile app for a seamless and convenient experience.

- In-person: Schedule an appointment at your local Scotiabank branch and apply in person with the assistance of a representative.

Conclusion

The Scotiabank Platinum American Express® Card stands as a premier credit card option, delivering outstanding rewards, benefits, and privileges to its users. Whether you’re jet-setting around the globe, indulging in retail therapy, or simply seeking a reliable and secure payment solution, this card is tailored to accommodate a diverse array of lifestyle preferences and necessities.

By applying for this card, you open the door to a realm of possibilities, where convenience and rewards converge to enhance your everyday experiences. For frequent travelers, the Scotiabank Platinum American Express® Card offers unparalleled benefits such as zero foreign transaction fees, complimentary airport lounge access, and comprehensive travel insurance coverage.

Meanwhile, avid shoppers can take advantage of double Scene+™ points on eligible purchases, ensuring that every dollar spent translates into valuable rewards. Moreover, the security features and customer service excellence associated with the American Express brand further bolster the appeal of this credit card.

Whether you’re making a purchase at home or abroad, you can rest assured knowing that your transactions are safeguarded and supported by a trusted financial institution. In essence, the Scotiabank Platinum American Express® Card transcends the conventional boundaries of a credit card, elevating your financial experience to new heights. Apply today and embark on a journey filled with unparalleled convenience, rewards, and peace of mind.